Helicap Secures $5m in Funding, Plans Indonesia Expansion

Jakarta. Singapore-based fintech company Helicap announced on Thursday (13/09) that it has secured $5 million in pre-Series A funding, led by Jakarta-based early-stage venture capital firm East Ventures and real-estate conglomerate Soilbuild Group Holdings, to expand its business in Indonesia.

This follows a $1.5 million seed funding round led by a former Singaporean manpower minister, Teo Ser Luck, and fintech firm Nufin Data four months ago.

Helicap has positioned itself as a bridge between large-scale investors, such as pension funds and insurance companies, to invest in small and medium enterprises through licensed peer-to-peer lenders. The company generates revenue from the fees it collects from investors.

The startup has helped disburse funding through peer-to-peer lending to more than 100,000 end consumers and small businesses in Singapore, Cambodia and Indonesia.

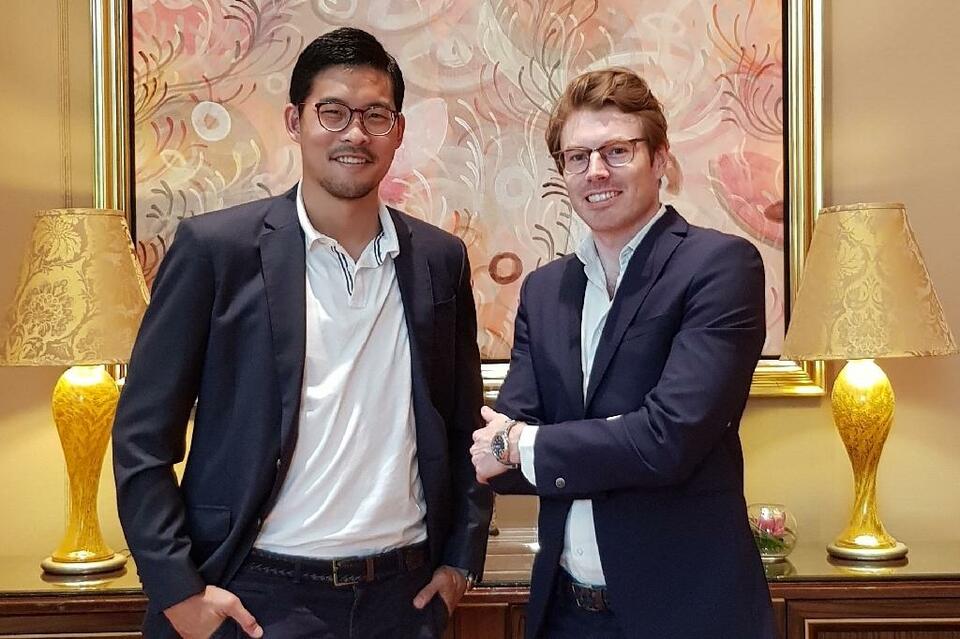

"We are putting our focus on Indonesia now. As we are going to expand in Indonesia, establish a new office and recruit a local team," David Z. Wang, Helicap co-founder and chief executive, told the Jakarta Globe on Thursday.

"We decided to work with East Ventures for our Indonesian expansion, as they are one of the earliest and most established venture capital players there. Also, Soilbuild's contribution is pivotal in diversifying our portfolio, particularly as they have deep expertise in the real estate investment trust listed-company segment," Wang said.

Helicap will hire tech teams to enhance data collection capacity and establish a risk management platform to assist the credit due diligence process.

The company has assessed 300 licensed partners, ranging from traditional microfinance institutions to digital lenders across Southeast Asia, helping to facilitate about 400 million potential borrowers in the region.

In Indonesia alone, Helicap plans to collaborate with 75 companies, which include licensed multi-finance and microfinance companies.

"Helicap, one of the newest inventive fintech firms in our portfolio, will play a significant role in validating and consolidating the region's emerging alternative lending space, as they're able to provide investors with expert information and superior risk-adjusted returns," East Ventures managing partner Willson Cuaca said in a statement.

Southeast Asia and Indonesia Expansion

Wang said the startup sees untapped opportunity in the region with its growing population and fragmented geography, especially Indonesia and the Philippines.

"Southeast Asia is one of the world's fastest-growing economic regions and has been primarily driven by SMEs. However, this growth has also generated a fragmented lending ecosystem, which hasn't been able to cater to the growing number of borrowers seeking capital to start a business," Wang said.

The company said the Indonesian government is active in addressing the issue and involving the fintech industry in its efforts.

"What's most important for us, is the very progressive and openness of the government to embrace fintech... Indonesia is at the forefront of fintech innovation and acceptance, which is really nice. We can see the openness of the government to embrace new technology," Wang said.

He added that the Indonesian economy is now facing short-term external challenges that may slow growth, but he believes Indonesia will return to its trajectory.

"We see that Indonesia's gross domestic product is very strong and the workforce is increasing. Generally, wealth is increasing. We actually focus on the local area, providing services to the population," Wang said.

"Ultimately, it is going to affect microbusinesses, but I think for us, we are a little more on the defensive, so it will affect us less," he said.

Helicap co-founder Quentin Vanoekel said the team is very bullish on the alternative lending space in the country, especially in the long run, if it is run sustainably.

"We are long-term investors. Our business will not be interrupted by short-term events. [We see] the Indonesian government and the central bank actually taking the right monetary and fiscal policies to make sure Indonesia is not impacted [by external factors]," Vanoekel said.

Wang said the company will also expand to the Philippines and Vietnam by the middle of next year and that it is currently conducting a study and observing those two markets.

Tags: Keywords:POPULAR READS

China’s Top Diplomat Wang Yi to Visit Indonesia for Cooperation Talks

Chinese top diplomat Wang Yi will chair a policy coordination meeting aimed at strengthening Indonesia-China cooperation.President Jokowi Urges Global Restraint as Tensions Rise in the Middle East

President Joko "Jokowi" Widodo emphasized the importance of diplomatic efforts to prevent the escalation of conflict in the Middle EastKPK Identifies Sidoarjo Regent as Suspect in Corruption Probe

KPK has identified Ahmad Muhdlor Ali as a suspect in a corruption case involving the Sidoarjo Regional Tax Service AgencyEconomic Concerns Overshadow Security Worries for Indonesians in Iran

Indonesian citizens currently in Iran are more concerned about rising inflation than the security situation in the country.'Siksa Kubur' Review: Indonesian Horror with Solid First Act

The beginning part of "Siksa Kubur" is incredibly solid across many fields, including the visual storytelling.Popular Tag

Most Popular