Mandiri Investasi Bets on 10 Percent AUM Growth in 2019

Jakarta. Mandiri Manajemen Investasi, part of state-lender Bank Mandiri, is confident its assets under management will grow 10 percent this year, optimistic over the country's economic growth, a director at the biggest locally-owned fund manager in Indonesia said.

Mandiri Investasi booked Rp 53 trillion ($3.7 billion) in its total assets under management (AUM), including mutual funds and discretionary funds last year. This represents a 5 percent growth from the previous year. Meanwhile, its AUM from its mutual fund product only stood at Rp 48 trillion last year.

"How do the prospects look in 2019? We are more optimistic, there are lots of opportunities from our businesses," Endang Astharanti, a director at Mandiri Investasi said at the sidelines of a Market Outlook presentation at Ritz Carlton Hotel, One Pacific, on Wednesday.

Endang said that Mandiri Investasi is confident consumer buying power will remain steady this year and expects the economy to grow at a healthy rate. Indonesia's economic growth reached 5.17 percent last year, a slight incline from 5.07 percent in 2017.

"We expect the capital markets to remain bullish this year," she said.

Mandiri Investasi said the company will intensify efforts for its existing products and extend by creating new portfolios to boosts its AUM.

Mandiri Investasi offers various investment products, from equity mutual funds, balanced mutual funds, fixed income mutual funds, money market mutual funds, protected mutual funds, special purposed funds to collective investment contracts with asset-backed securities.

Alternative Investment

To extend, Mandiri Investasi is aggresively developing alternative investments.

Mandiri Investasi launched various products to this end last year, including asset-backed securities under collective investment contracts (KIK-EBA) – called Mandiri GIAA01 – worth Rp 2 trillion. The product is among first security that invests in the right over revenue from airline tickets with routes from Indonesia to Jeddah and Madina as underlying assets.

Mandiri Investasi also issued funds designed for project financing in infrastructure (RDPT MIET) with a total value of Rp 1.97 trillion, specifically for the development of the Trans Java toll road.

The fund manager also inked a strategic agreement with Lombard Odier last year, a Geneva-based private bank to develop a private banking arm, through investment and family services. The deal is expected to entice wealthy Indonesians to onshore funds sitting in Singapore.

Tags: Keywords:POPULAR READS

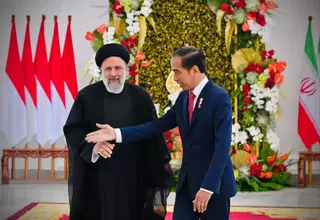

President Jokowi Urges Global Restraint as Tensions Rise in the Middle East

President Joko "Jokowi" Widodo emphasized the importance of diplomatic efforts to prevent the escalation of conflict in the Middle EastKPK Identifies Sidoarjo Regent as Suspect in Corruption Probe

KPK has identified Ahmad Muhdlor Ali as a suspect in a corruption case involving the Sidoarjo Regional Tax Service AgencyEconomic Concerns Overshadow Security Worries for Indonesians in Iran

Indonesian citizens currently in Iran are more concerned about rising inflation than the security situation in the country.'Siksa Kubur' Review: Indonesian Horror with Solid First Act

The beginning part of "Siksa Kubur" is incredibly solid across many fields, including the visual storytelling.IDX Slides 2 Percent as Geopolitical Conflict Rattles Market Confidence

The IDX attributed the subdued performance of the index at the start of the week to the escalating geopolitical tensions in the Middle EastPopular Tag

Most Popular