Expected Shortages Boost Crowd-Pulling Power of Copper Mines

London. An expected global shortage of copper in years to come has thrown a spotlight on the value of mines that produce the metal, with scouts from private equity firms, trading houses and miners sniffing out potential targets.

Strong interest in good quality copper assets was recently highlighted by Sumitomo Metal Mining buying another 13 percent stake in Freeport-McMoRan's Morenci mine for $1 billion.

On Thursday (10/3), Swedish mining and smelting group Boliden struck a deal to buy the Kevitsa mine in northern Finland for a cash consideration of $712 million.

"Copper is the most sought after commodity, it's a good time to buy copper assets now, there are some very visible deficits coming up at the end of this decade," said Simon Lovat, a commodity analyst at fund firm Carmignac.

Forecasts for more than two years out are difficult as much could change, but there are some; Deutsche Bank analysts expect small surpluses this year and next, a deficit of 280,000 tonnes in 2018, 350,000 in 2019 and 280,000 in 2020.

The problem is mainly on the supply side, partly in top producer Chile, where output has slipped in recent years.

Chile's copper output last year was 5.76 million tonnes, about 25 percent of the global total, and expectations are for further falls due to deteriorating ore grade and a lack of investment in the mining and power industries.

Elsewhere around the world, the quality of the ore is not what it was and, despite copper's surge from $1,500 to above $10,000 a tonne between 2002 and 2011, no new, large, game-changing deposits have been found.

The prospect of deficits has attracted attention.

"Major Japanese trading houses trade commodities locally and internationally. They have over time been increasing their exposure to mining," said Raj Karia, Head of Corporate, M&A and Securities at Norton Rose Fulbright.

"Trading houses broadly should be looking to pick up assets to integrate their trading operations with ownership of assets.

There is substantial private equity capital available for mining, some estimate about $10 billion globally."

Private equity firms looking at mining include Madison Dearborn, Denham Capital Management, KKR, Apollo Global management, Resource Capital Funds and Orion Resource Partners, according to data provider Preqin.

Banking sources say private equity on average accounts for more than 50 percent of participants in potential mining M&A deals. "They are there in case the process fails, they can then scoop up distressed assets for a song," one banker said.

X2 Resources, a mining venture, supported by Noble Group, TPG Capital, sovereign wealth funds and pension investors, is also in the fray.

Rio Tinto's Chief Executive Sam Walsh last month said his team was keeping an eye out for top-tier assets, particularly in copper.

South32 also recently joined the ranks of miners willing to make acquisitions. "Copper is obviously attractive given the supply demand fundamentals," the company's Managing Director Graham Kerr said in February.

"The Chinese are there too, they need copper, they have to import it," a banking source said.

Copper mines under the hammer include Glencore's Lomas Bayas mine in Chile and Cobar in Australia.

But overall, though there are many mining assets up for sale, few produce copper. So, the focus will increasingly turn to smaller copper miners such as First Quantum and Central Asia Metals, with low production costs.

"Good copper mines are a compelling investment, because they are a depleting asset," said Allianz Global Investors UK equities portfolio manager Matthew Tillett, who recently bought shares in both companies.

"The supply numbers analysts have in their models are unlikely to happen in reality if prices aren't high enough...My main concern is demand coming in below expectations."

Others agree much depends on China, the world's largest consumer of the metal used in power and construction, where demand growth slowed to around 2 percent last year and is expected slow further over coming years, possibly towards zero.

Reuters

Tags: Keywords:POPULAR READS

KPK Identifies Sidoarjo Regent as Suspect in Corruption Probe

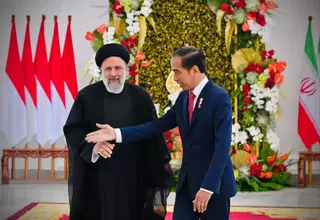

KPK has identified Ahmad Muhdlor Ali as a suspect in a corruption case involving the Sidoarjo Regional Tax Service AgencyEconomic Concerns Overshadow Security Worries for Indonesians in Iran

Indonesian citizens currently in Iran are more concerned about rising inflation than the security situation in the country.IDX Slides 2 Percent as Geopolitical Conflict Rattles Market Confidence

The IDX attributed the subdued performance of the index at the start of the week to the escalating geopolitical tensions in the Middle EastRupiah Declines Against Dollar Amid Geopolitical Unrest

The Indonesian rupiah depreciated against the US dollar in Tuesday's trading session, driven by escalating tensions between Iran and IsraelNasdem Vows to Honor the Constitutional Court Ruling on 2024 Presidential Election Dispute

Nasdem's Willy Aditya commits to respect the Constitutional Court's ruling on the 2024 presidential election dispute.Popular Tag

Most Popular