The New World of Virtual Banks: Profitable Growth Will Define Success

Progressive regulation is creating open and collaborative ecosystems with both banks and customers moving up the technological maturity scale. With customer sentiment ripe for a new way of banking, virtual banks need to grow at scale, leveraging open, cloud-based platforms.

While a perfect storm supporting the growth of virtual banks is brewing, success is not guaranteed unless new banks can transform into data-driven, high-performance and profitable organizations.

Virtual banks globally have done well in the onboarding process, but must prove themselves across the financial lifecycle as they expand into more complex

product areas, such as small- and medium-enterprise banking, mortgages and business banking.

A global survey by Oracle showed that existing customers of traditional incumbent banks are ready for churn, not at the beginning of the lifecycle, but when more complexity appears in the relationship. This is where the rubber meets the road.

Virtual banks must have a nimble, friction-free approach across processes and an ability to act on customer data insights to elevate the overall service experience.

Virtual Banking in Indonesia

Last year, the country launched the roadmap of its Making Indonesia 4.0 initiative with a clear target to improve innovation and technology while linking it to economic outcomes. Banks will play an important role in this economic uplift by providing an environment that supports this initiative.

Indonesia has also made rapid strides in financial inclusion, aiming for more of its population to have bank accounts.

Leading regional and local players have seized the opportunity to create a competitive advantage. DBS launched Digibank Indonesia in August 2017, with more than 460,000 customers as of May 2019.

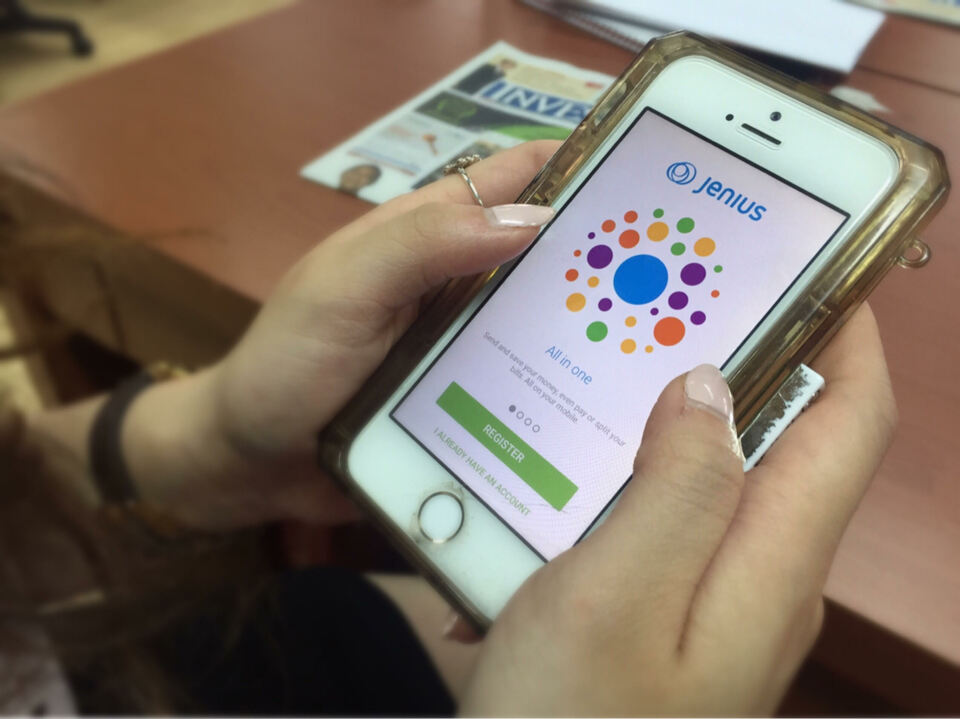

Bank Tabungan Pensiunan Nasional launched Jenius, Indonesia's first digital bank, and introduced a mobile banking application to allow customers to manage their finances using smartphones, bringing seamless banking to the fingertips of a new generation.

Yet, there is still a gap that must be filled – especially in the underserved segment, as well as SMEs, which account for nearly 97 percent of domestic employment in Indonesia.

To move to virtual or digital-only banks that are specifically targeting the underserved segment could open another source of funding. This development is a net value add to the Indonesian enterprise, bridging a crucial lifeline where it is most required.

Additionally, the convergence of Islamic banking principles with the advancement of virtual banking could accelerate the development of the world's first Islamic virtual bank.

Critical Aspects

For virtual banks to be successful, they must get a few critical aspects right. Key among this is the use of data. Virtual banks can leverage data insights via agile technology stacks to offer the customer unique personalization. To grow market share and reduce churn, it is critical to implement analytical architecture and automation through artificial intelligence and machine learning.

To ensure long-term profitability, data-driven tools should be used to optimize capital allocation, customer data management and risk mitigation. The following four aspects are fundamental to ensure virtual banks grow, scale and remain profitable.

- Operating Model and Speed to Market

This is a critical factor for digital banks to succeed in their operating models and unique value proposition. Traditional banks have long relied on interest income to drive growth and have only used technology as an enabler to run the business. By challenging the norms and using technology as a core value driver to provide the most compelling value proposition to customers, virtual banks can respond to market demands with speed and agility. Digital banks can have a disruptive impact for years to come with their ability to fail fast and proceed with rapid prototyping to bring relevant products to market.

- Ecosystem Partnerships

By designing the bank to deliver to the ecosystem, virtual banks inherently unlock greater value and stronger revenue streams. This will also allow virtual banks to offer better value propositions by co-creating innovative products through various cross-industry partnerships.

The ability to tie up options for e-commerce, transport, lifestyle and payment all in one seamless digital banking experience with the use of open APIs, or publicly available application programming interfaces, is critical. Virtual banks can scale and react with speed and agility to incorporate new products and processes onto their platforms and easily connect with third-party products, offering more choices to the end-user.

- Role of CFOs and Customer-Facing Teams

Chief financial officers have an increased responsibility for providing data-driven business enablement. Research by Oracle and Asia Risk shows that 66 percent of global banking executives consider aligning financial performance and risk data very important, or critical, to success. A common analytics platform helps to provide a real-time picture of a bank's business and aligns finance, risk and performance management strategies under the same data-decisioning engine and platform.

- Regulatory Compliance

Anti-money laundering technologies, such as graph analytics and machine learning, applied to histories of transactional data, can help virtual banks curtail criminal flows of capital that put their customers at risk. With current developments in the business and regulatory landscape and to the extent permitted by laws, virtual banks may use the know-your-customer principle, risk or compliance data associated with running a new bank to gain business insight.

The new wave of virtual banks will need to journey through different stages of ongoing adaptation in their bid for growth and profitability, greater customer traction and market share.

Oracle is assisting banks in redesigning the customer journey – right from the API strategy, front-end customer-facing applications to the back-end rails of modern and digital core platforms. The result is better digital services that boost customer value and understanding their needs more deeply across the financial lifecycle.

Venky Srinivasan is group vice president for Japan and Asia-Pacific sales at Oracle Financial Services.

Tags: Keywords:POPULAR READS

Nissan to Make Next-Generation EV Batteries by Early 2029

Solid-state batteries are widely seen as the next step for EVs.Airlangga Set to Extend Leadership in Golkar After Election Success

Under his leadership, Golkar rose to the second position in the legislative polls and successfully made Gibran the elected vice president.Yellen Says Iran's Actions Could Cause Global 'Economic Spillovers'

Iran's missile attack on Israel early Sunday came in response to what it says was an Israeli strike on Iran's consulate in Syria.Takeaways from Prabowo's Responses to Legal Motion Contesting His Election Win

Part of the argument addresses the claim that the candidacy of Gibran Rakabuming Raka, Prabowo’s running mate, is unlawful.Prabowo Camp Cites ‘Procedural Error’ in Legal Challenge by Rival Candidates

The Constitutional Court's main task is to address alleged discrepancies in vote tallies, which neither of the plaintiffs challenged.Popular Tag

Most Popular